As a student or parent, navigating the world of tax forms can be overwhelming, especially when it comes to understanding the 1098-T tax form. Kennesaw State University (KSU) is committed to helping you make sense of this important document. In this comprehensive guide, we'll break down the ins and outs of the 1098-T tax form, its purpose, and how to use it to your advantage.

What is the 1098-T Tax Form?

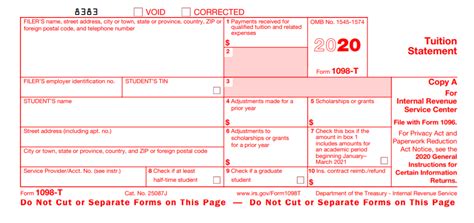

The 1098-T tax form, also known as the Tuition Statement, is a document provided by educational institutions like Kennesaw State University to students and their families. Its primary purpose is to report tuition payments and other related expenses to the Internal Revenue Service (IRS). The form is used to help students and their families claim education-related tax credits and deductions.

Why is the 1098-T Tax Form Important?

The 1098-T tax form is essential for several reasons:

- Tax Credits and Deductions: The form provides critical information needed to claim tax credits and deductions, such as the American Opportunity Tax Credit and the Lifetime Learning Credit.

- Reporting Requirements: The IRS requires educational institutions to report tuition payments and other related expenses on the 1098-T tax form.

- Student Financial Aid: The form helps students and their families understand their financial aid and the impact of tuition payments on their tax obligations.

Understanding the 1098-T Tax Form

The 1098-T tax form typically includes the following information:

- Student's Name and Address: The student's name and address, as well as their Social Security number or Individual Taxpayer Identification Number (ITIN).

- University's Name and Address: The name and address of Kennesaw State University, as well as its Employer Identification Number (EIN).

- Account Number: The student's account number or other identifying information.

- Tuition Payments: The total amount of tuition payments made during the tax year.

- Related Expenses: Other related expenses, such as fees, room, and board.

How to Use the 1098-T Tax Form

To use the 1098-T tax form effectively, follow these steps:

- Review the Form: Carefully review the form to ensure accuracy and completeness.

- Gather Additional Documents: Collect any additional documents needed to support your tax credits and deductions, such as receipts for textbooks and course materials.

- Claim Tax Credits and Deductions: Use the information on the 1098-T tax form to claim tax credits and deductions on your tax return.

- Consult a Tax Professional: If you're unsure about how to use the 1098-T tax form or need help with your tax return, consider consulting a tax professional.

Common Questions and Answers

Here are some common questions and answers related to the 1098-T tax form:

- What is the deadline for receiving the 1098-T tax form?: The deadline for receiving the 1098-T tax form is typically January 31st of each year.

- Can I access my 1098-T tax form online?: Yes, Kennesaw State University provides online access to the 1098-T tax form through its student portal.

- How do I correct errors on my 1098-T tax form?: If you find errors on your 1098-T tax form, contact Kennesaw State University's Student Financial Services department for assistance.

Gallery of 1098-T Tax Form

Frequently Asked Questions (FAQ)

What is the purpose of the 1098-T tax form?

+The 1098-T tax form is used to report tuition payments and other related expenses to the Internal Revenue Service (IRS), helping students and their families claim education-related tax credits and deductions.

How do I access my 1098-T tax form?

+Kennesaw State University provides online access to the 1098-T tax form through its student portal. You can also contact the university's Student Financial Services department for assistance.

What if I find errors on my 1098-T tax form?

+If you find errors on your 1098-T tax form, contact Kennesaw State University's Student Financial Services department for assistance. They will help you correct the errors and provide an updated form.

By following this comprehensive guide, you'll be well on your way to understanding the 1098-T tax form and how to use it to your advantage.