In today's fast-paced world, securing one's financial future has become a top priority. With the numerous life insurance options available, choosing the right one can be overwhelming. One option that stands out is Trustmark Universal Life Insurance. This type of insurance offers a unique combination of death benefit protection and a savings component that can help you achieve your long-term financial goals. In this article, we will delve into the five benefits of Trustmark Universal Life Insurance, exploring how it can provide you with peace of mind and financial security.

Flexibility in Premium Payments

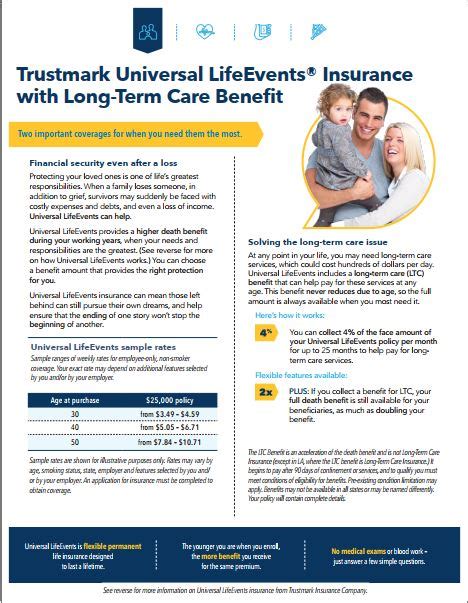

One of the significant advantages of Trustmark Universal Life Insurance is its flexibility in premium payments. Unlike traditional life insurance policies, which require fixed premium payments, universal life insurance allows you to adjust your premium payments based on your changing financial situation. This means that if you're experiencing financial difficulties, you can reduce your premium payments or even skip them altogether, as long as you have sufficient cash value in your policy.

Tax-Deferred Growth

Another benefit of Trustmark Universal Life Insurance is its tax-deferred growth. The cash value of your policy grows tax-deferred, meaning you won't have to pay taxes on the gains until you withdraw them. This can be a significant advantage, especially if you're looking to accumulate wealth over time. Additionally, the tax-deferred growth can help your policy's cash value grow faster, providing you with more funds to use in the future.

Death Benefit Protection

Trustmark Universal Life Insurance also provides a death benefit to your beneficiaries in the event of your passing. The death benefit is typically tax-free and can be used to pay off outstanding debts, cover funeral expenses, or provide financial support to your loved ones. The death benefit can also be increased or decreased over time, allowing you to adjust your coverage based on your changing needs.

Cash Value Accumulation

Universal life insurance policies, including Trustmark, allow you to accumulate cash value over time. The cash value can be used to pay premiums, take loans, or withdraw funds to supplement your retirement income. The cash value grows based on the performance of the policy's underlying investments, providing you with a potential source of funds in the future.

Customization Options

Finally, Trustmark Universal Life Insurance offers customization options that allow you to tailor your policy to your individual needs. You can choose from a range of riders and add-ons, such as long-term care riders, waiver of surrender charge riders, and accidental death benefit riders. These customization options can help you create a policy that meets your specific financial goals and objectives.

Gallery of Universal Life Insurance

What is Trustmark Universal Life Insurance?

+Trustmark Universal Life Insurance is a type of life insurance that combines a death benefit with a savings component, allowing you to accumulate cash value over time.

How does Trustmark Universal Life Insurance work?

+Trustmark Universal Life Insurance works by allowing you to pay premiums, which are then invested to accumulate cash value. The cash value can be used to pay premiums, take loans, or withdraw funds to supplement your retirement income.

What are the benefits of Trustmark Universal Life Insurance?

+The benefits of Trustmark Universal Life Insurance include flexibility in premium payments, tax-deferred growth, death benefit protection, cash value accumulation, and customization options.

In conclusion, Trustmark Universal Life Insurance offers a range of benefits that can help you achieve your long-term financial goals. From flexibility in premium payments to tax-deferred growth, death benefit protection, cash value accumulation, and customization options, this type of insurance can provide you with peace of mind and financial security. If you're considering purchasing a life insurance policy, Trustmark Universal Life Insurance is definitely worth exploring.