The insurance industry is a complex and ever-evolving field, with numerous players vying for market share and customer trust. One of the key indicators of an insurance company's financial strength and stability is its rating from A.M. Best, a leading credit rating agency that specializes in assessing the financial health of insurance companies. Recently, Universal Property and Casualty (UPC) Insurance Company received its A.M. Best rating, which has significant implications for the company, its policyholders, and the broader insurance industry.

Understanding A.M. Best Ratings

A.M. Best ratings are a widely recognized benchmark of an insurance company's financial strength, operating performance, and ability to meet its obligations to policyholders. The ratings are based on a comprehensive evaluation of a company's balance sheet strength, operating performance, business profile, and enterprise risk management. A.M. Best uses a letter-grade system, with A++ being the highest rating and F being the lowest.

Universal Property and Casualty Insurance Company

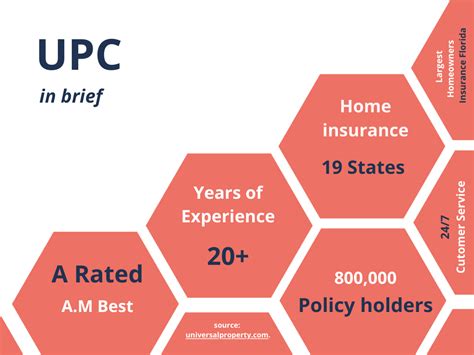

Universal Property and Casualty Insurance Company is a leading provider of property and casualty insurance products, offering a range of coverage options for individuals, families, and businesses. The company has a strong presence in the market, with a reputation for delivering excellent customer service and competitive pricing.

A.M. Best Rating for Universal Property and Casualty

The A.M. Best rating for Universal Property and Casualty Insurance Company has been revealed, and it is a testament to the company's financial strength and stability. According to A.M. Best, Universal Property and Casualty has been assigned a rating of A- (Excellent), which indicates that the company has a strong ability to meet its obligations to policyholders.

Breakdown of the A.M. Best Rating

The A.M. Best rating for Universal Property and Casualty is based on a comprehensive evaluation of the company's financial performance, business profile, and risk management practices. Here is a breakdown of the key factors that contributed to the company's A- (Excellent) rating:

- Financial Strength: Universal Property and Casualty has a strong balance sheet, with a significant amount of capital and surplus. The company's financial strength is further enhanced by its conservative investment strategy and robust reinsurance program.

- Operating Performance: The company has a proven track record of delivering strong operating results, with a history of profitable underwriting and solid investment income.

- Business Profile: Universal Property and Casualty has a well-established market presence, with a strong distribution network and a diverse range of insurance products.

- Enterprise Risk Management: The company has a robust risk management framework, with a strong focus on identifying, assessing, and managing potential risks.

Implications of the A.M. Best Rating

The A.M. Best rating for Universal Property and Casualty has significant implications for the company, its policyholders, and the broader insurance industry. Here are some of the key implications:

- Policyholder Confidence: The A- (Excellent) rating from A.M. Best is a testament to Universal Property and Casualty's financial strength and stability, which can enhance policyholder confidence in the company.

- Market Competitiveness: The rating can also enhance the company's market competitiveness, as it provides a third-party validation of the company's financial health and stability.

- Regulatory Compliance: The rating can also help the company to comply with regulatory requirements, as many regulators use A.M. Best ratings as a benchmark for assessing an insurer's financial health.

Gallery of Insurance Company Ratings

Frequently Asked Questions

What is the A.M. Best rating for Universal Property and Casualty?

+The A.M. Best rating for Universal Property and Casualty is A- (Excellent).

What does the A.M. Best rating mean for policyholders?

+The A.M. Best rating is a testament to the company's financial strength and stability, which can enhance policyholder confidence in the company.

How does the A.M. Best rating affect the company's market competitiveness?

+The rating can enhance the company's market competitiveness, as it provides a third-party validation of the company's financial health and stability.

As we conclude, the A.M. Best rating for Universal Property and Casualty is a significant achievement that reflects the company's financial strength and stability. We hope this article has provided valuable insights into the importance of A.M. Best ratings and their implications for insurance companies and policyholders. If you have any further questions or comments, please feel free to share them below.